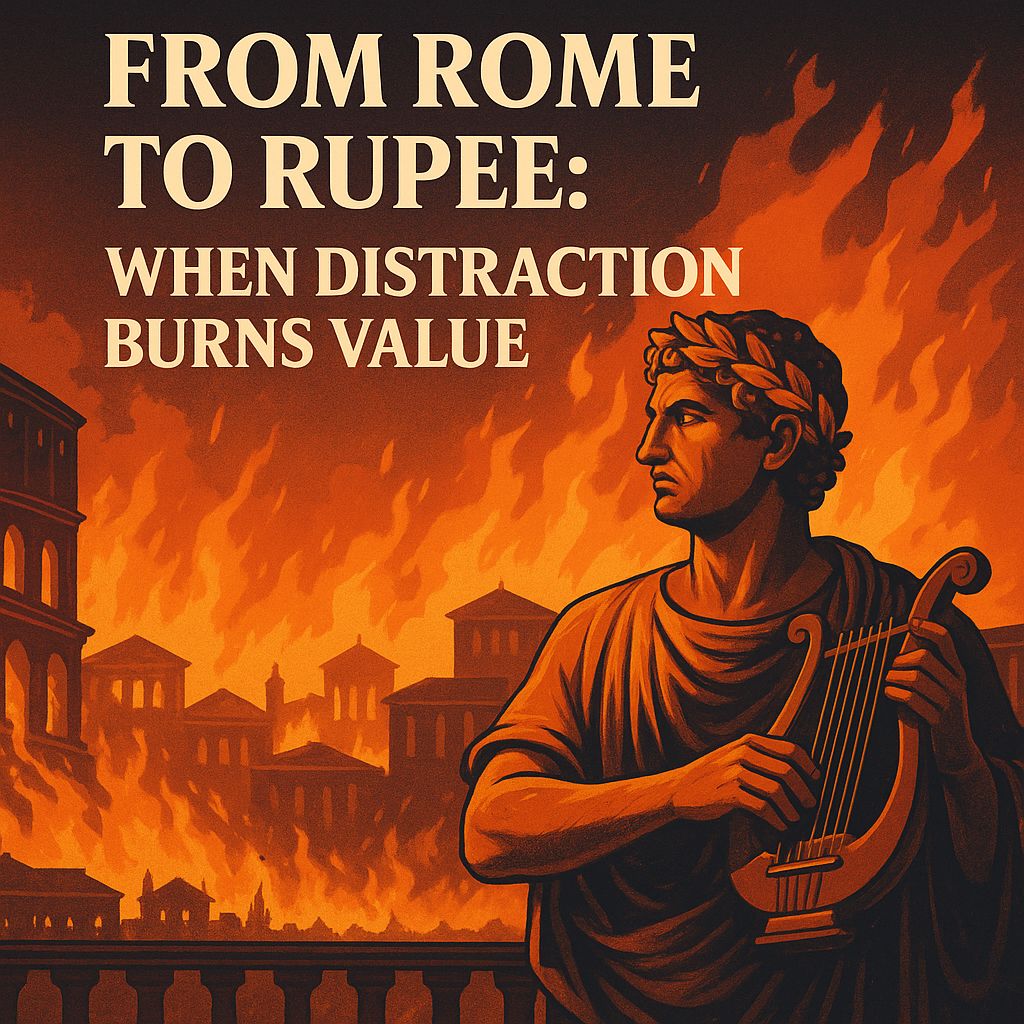

Legend says that when Rome caught fire, Emperor Nero stood on his balcony and played his fiddle. Historians still debate whether he caused the blaze or merely ignored it — but what’s certain is that while the city burned, the leader was focused elsewhere.

Last week, Pakistan’s markets had a similar undertone — real fire but focus somewhere else. Traders were left in disarray as:

- $11 billion trade misreporting raised questions about data reliability and under-invoicing

- IMF mission left without signing the SLA, signalling deeper scrutiny and potential delays

- Political rifts widened from KPK to the PMLN–PPP corridors

- Current-account deficit persisted

- Regional tensions reignited with India and Afghanistan

Headlines were something else — and the fiddle playing was:

- The Saudi–Pakistan Pact

- Talk of new investment inflows

- The first mineral shipment to the U.S.

Meanwhile, the market told its own story:

- Exporters stopped selling dollars in the forward market

- The stock market tumbled nearly 5,000 points

- Interest rates ticked upward again

It’s said that nearly two-thirds of Rome turned to smoke that night. But from that point on, Nero reimagined the city — wider streets, stone instead of wood, stricter urban codes.

That’s the kind of re-imagination we need today — to rebuild not just on optics, but on real reform across every layer of the economy.

USDPKR Outlook

Exporters had been aggressively selling dollars in spot, discounting, and forwards for the last four weeks, but last week those flows slowed to a drip — for the reasons mentioned above. They’re jittery about the currency’s direction, and swap premiums have softened, losing their attractiveness.

Last week we spoke about SBP’s short swap book, now down to about $2 billion. Since the IMF target for Dec 2025 is also $2 billion and there’s still three months to go, it seems SBP is again doing buy-sell swaps — draining liquidity from the interbank and pressuring swaps across all tenors. Yesterday, the Governor also mentioned that SBP has bought $20 billion from the interbank market over the last three years to prop up reserves.

We continue to anticipate PKR strengthening despite the noise. Clients should keep hedging forwards up to three months, and selectively hedge between the 3- to 12-month tenors. Swaps are expected to remain soft this month.

Metals — The New Oil

Gold, silver, and copper — the world’s three most-watched metals — are writing very different stories in 2025. Gold has reclaimed its throne, soaring past $4,000 as central banks, led by China, rush to diversify away from the dollar.

Silver, long the quiet workhorse, has turned explosive — up more than 60% this year on tight supply and booming demand from EVs, solar, and even missile systems. And copper, dubbed the oil of the 2020s, faces a short-term slowdown in the U.S. and China but remains the backbone of electrification and AI infrastructure.

#Rupee #Pakistan